Kyc Process Flow

The concept of cash laundering is very important to be understood for those working in the financial sector. It is a course of by which dirty money is converted into clean money. The sources of the cash in precise are legal and the money is invested in a approach that makes it seem like clear cash and hide the identity of the prison a part of the money earned.

While executing the monetary transactions and establishing relationship with the new prospects or maintaining existing customers the obligation of adopting ample measures lie on each one who is part of the organization. The identification of such element in the beginning is simple to take care of as an alternative realizing and encountering such situations in a while in the transaction stage. The central financial institution in any country supplies complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present enough security to the banks to deter such conditions.

Submitting additional identity verification and documentation eIDV etc. Processing KYC outside of the transaction flow.

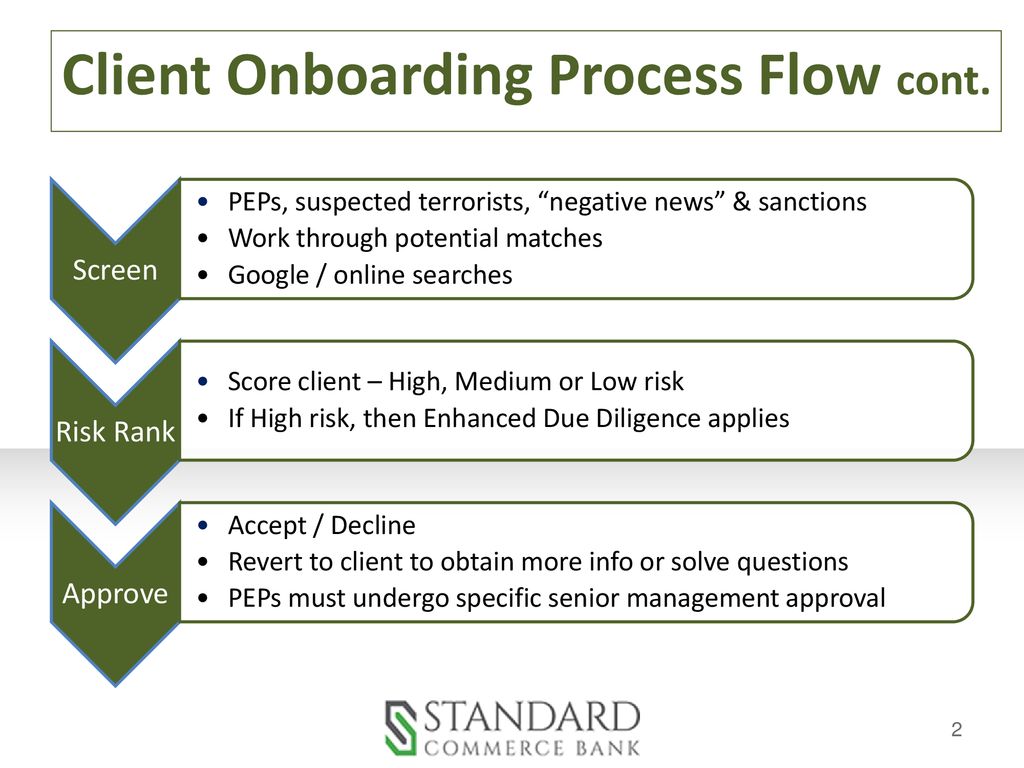

Client Onboarding Process Flow Ppt Download

This proposed document explains the workprocess flow to use the e-KYC services for opening of accounts through branches and BC locations.

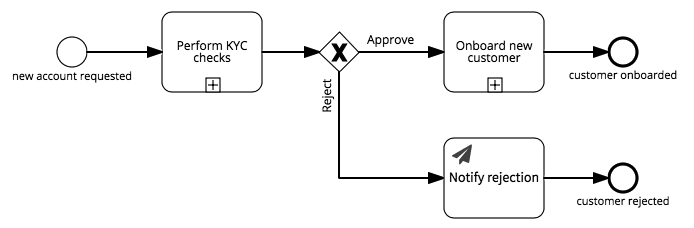

Kyc process flow. So how frequently will it be done. A simple KYC process flow is depicted below. This process would be done periodically depending on the risk of the customer.

KYC process flow KYC and Customer Due Diligence measures. As banks move from periodic and event-driven reviews process automation helps them manage the shift. The KYC process is simple and differs only slightly from country to country.

We were unable to load the diagram. Process Flow Document for e-KYC and account opening at BC locations Branches Purpose. The full form of KYC is Know Your Customer.

The first step in KYC verification involves the collection of personal information from an online user. While the refined KYC-process was deemed to be suitable to be integrated into an ICO investment flow from a technical viewpoint it became evident that regulatory issues arise from not yet considering the above-described developments of KYC- and AML-regulations which might have severe consequences not only for the implementation but also the. You can edit this template and create your own diagram.

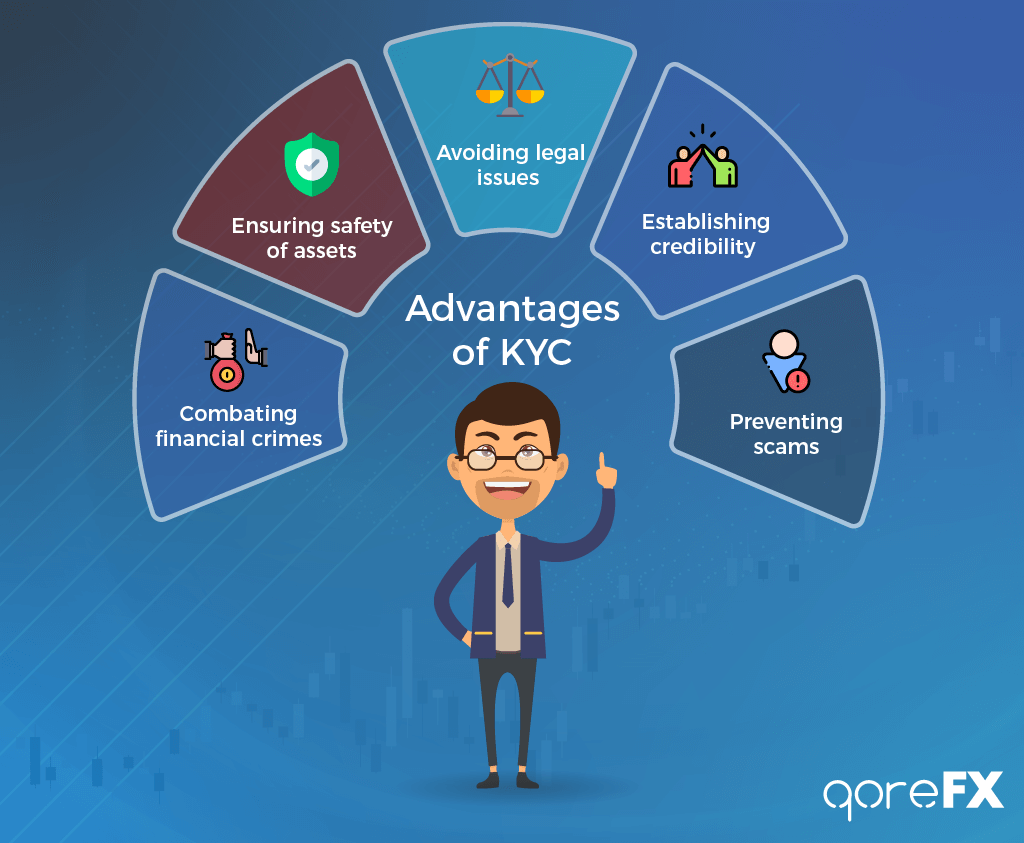

Our customizable tool allows companies to carry out corporate risk scoring business verification and other AMLKYC processes with speed and simplicity. For example the KYC flow for high-risk countries can include original ID document verification face matching liveness check and AML Screening. Effective KYC involves knowing a customers identity their financial activities and the risk they pose.

Here we discuss the importance of KYC in this context and how you can. The KYC policy is a mandatory framework for banks and financial institutions used for the customer identification process. What Is The Kyc Process.

According to your risk management and the requirements of your regulator you can set up several verification flows. After CIP the next phase in the AML KYC onboarding lifecycle process is the customer due diligence CDD phase which involves assessing the client or customer to determine whether that person or company should be given a low medium or high-risk AML rating. 1 Go to the KYC verification page on the website of the bank or financial platform whose services you are interested in.

The process consists of a series of checks implemented in the first stage of the relationship with the client to verify that he is who he says he is taking into account his. With increased external pressure from regulators and an internal desire to improve compliance measures you know that change is necessary to modernise your KYC process flow. This allows you to pre-screen customers and make risk-based assessments before submitting any transaction requests.

Processing KYC documents work flow Flowchart Use Createlys easy online diagram editor to edit this diagram collaborate with others and export results to multiple image formats. Using this service we conduct electronic identity verification using biometrics of the prospective customers. It automates once manual email and telephone communications and gives your customers self-service access to more quickly and easily review and respond to case queries eg.

KYC Flows web portal improves customer experience by transforming your KYC customer outreach processes. KYC is a process carried out by financial institutions like banks stockbroking firms fund houses etc to verify the identity and address of the customer. Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship.

Resource-draining onboarding is over KYC-Chains Corporate KYC end-to-end workflow solution is able to screen both individual and corporate entities. AML KYC Process Flow. Just like the way traditional banking institutions were used to verify an identity online KYC verification is performed.

The KYC process flow for verification via Aadhaar OTP is quite simple. Whether youre scaling your business or simply need to reduce the time spent on KYC without increasing resources you might be considering KYC automation. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws.

The KYC process can follow the following steps although not always in the same order. As we have already discussed in other entries of the blog Know Your Customer or KYC is a procedure to identify and verify a customers identity. Operators can now complete KYC Know Your Customer of MuchBetter customers outside of the transaction flow.

KYC Verification Process Steps. Since the passing of the Patriot Act KYC processes. 3 You will be then prompted to enter the OTP sent to the mobile number registered on your Aadhaar card.

Its origin stems from the 2001 Title III of the Patriot Act to provide various tools to prevent terrorist activities. Our KYC software lets you easily create multiple verification processes for one company. Depending on the scale of automated reviews and share of customers subject to those processes banks have been able to streamline KYC work by 20 to 30 percent.

The evolution of KYC. KYC verification process steps include. 2 Submit your Aadhaar number and other details.

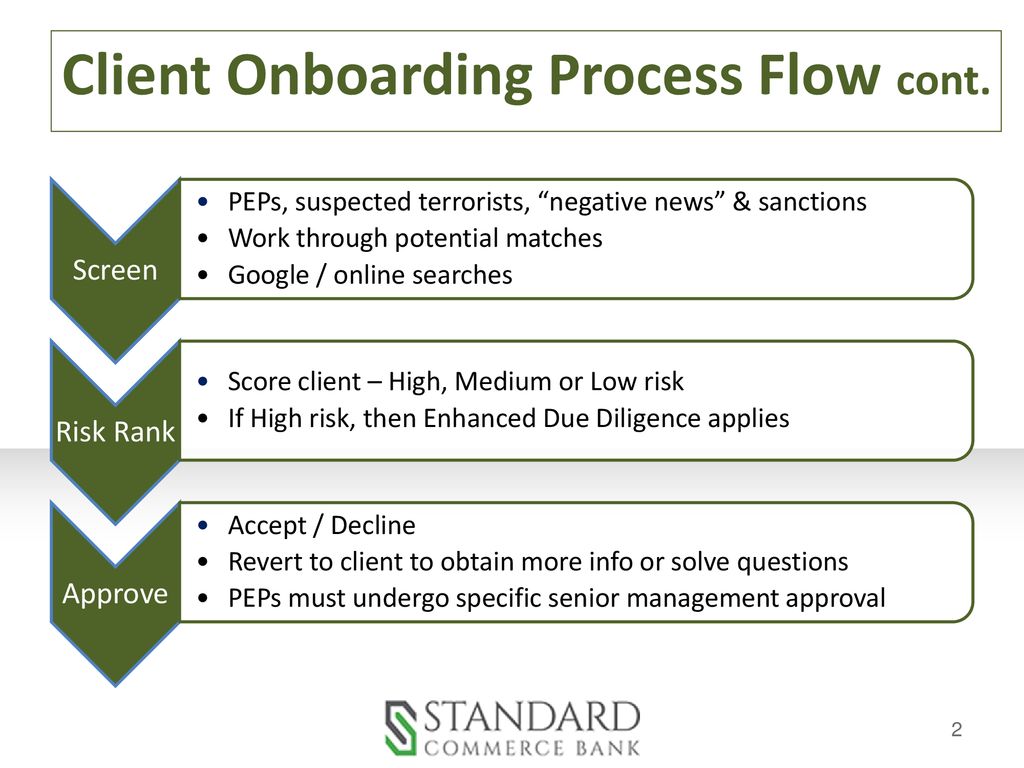

Kyc Area Needs Modernization Accelerate Estonia

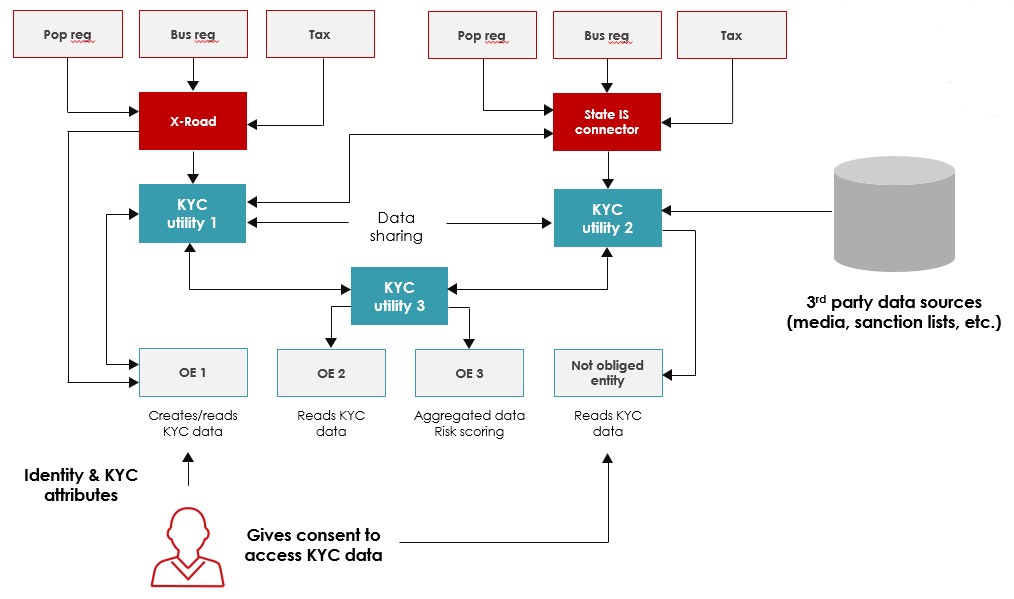

Know Your Customer Kyc Banking Processes In Signavio Workflow

Seamless Sim Card Registration For Kyc Compliance Papersoft

Kyc Aml Onboarding Process Customer Ppt Powerpoint Presentation File Backgrounds Powerpoint Presentation Images Templates Ppt Slide Templates For Presentation

Aml Kyc Onboarding Lifecycle Process Flow Guide Advisoryhq

Workflow Of Client Onboarding Process Kyc Status Update Ppt Slides Presentation Graphics Presentation Powerpoint Example Slide Templates

Design Of The Kyc Solution Download Scientific Diagram

Everything You Need To Know About Kyc Qorefx

Aml Kyc Onboarding Lifecycle Process Flow Guide Advisoryhq

Video Kyc Process A Simple Use Case

Know Your Customer Kyc Process Guide For Banking

6 Steps To An Effective Kyc In 2021 Basis Id

Jasa Dan Layanan E Kyc Online Di Jambi Blog Informasi Tanda Tangan Elektronik Digital Signature Enkripa

Know Your Customer Kyc Banking Processes In Signavio Workflow

The world of rules can appear to be a bowl of alphabet soup at times. US cash laundering laws are not any exception. We have now compiled a listing of the top ten cash laundering acronyms and their definitions. TMP Threat is consulting firm focused on defending monetary companies by decreasing threat, fraud and losses. We've got massive financial institution experience in operational and regulatory threat. We've a strong background in program administration, regulatory and operational threat as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many adverse penalties to the group because of the dangers it presents. It will increase the probability of major dangers and the chance cost of the financial institution and ultimately causes the bank to face losses.

Comments

Post a Comment